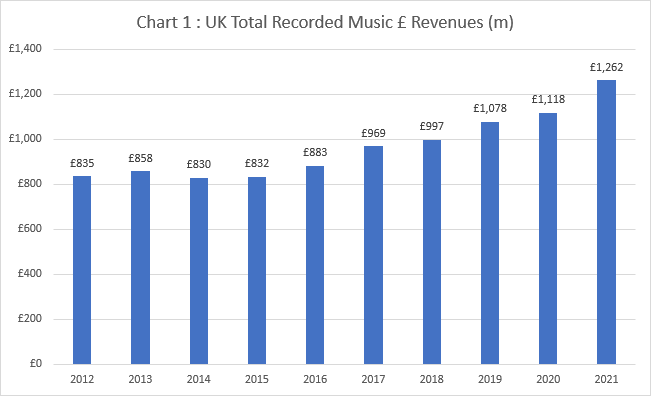

The BPI has reported that UK recorded music trade revenue rose by 12.8% in 2021 to reach £1.262 billion.

It marks the sector’s seventh consecutive year of revenue growth, which was led by streaming in terms of volume. But the BPI noted that, taking inflation into account, the results for 2021 are below the equivalent in 2006 by £368 million (based on a consumer prices index adjustment) or £534m (retail price index adjustment).

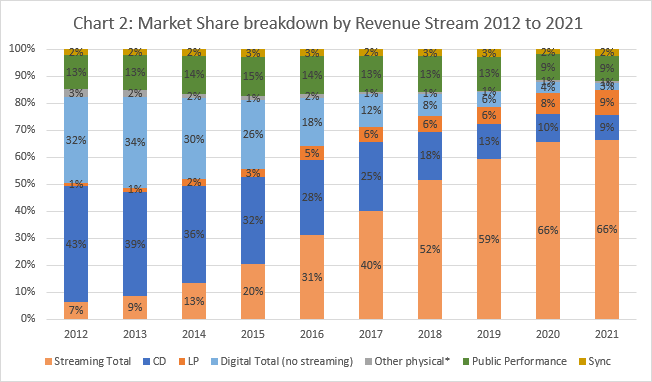

Because it now represents 66% trade income (and 83% in terms of units consumption), revenue from streaming again fuelled much of the rise, up 13.7% year-on-year to £837.2m.

Subscription revenue rose by 13% to £734.5m, though ad-funded streaming income grew by 15.7% to £49.1m. It comes as major labels are reporting the growth of licensed ad-funded platforms in terms of revenue.

Income from video streaming platforms, notably YouTube, was up 22.6% to £53.7 million. Revenue from digital downloads continued to decline (down 23.3%).

Revenue from physical formats on CD and vinyl grew at a faster rate than streaming, up by 14.6% to £241 million. These figures coincided with an increase in the number of indie record shops, which went from 390 in 2020 to 407 in 2021 (according to ERA figures).

Vinyl revenue soared by 34% (thanks in part to rising prices) to £117.2m, but perhaps the real achievement for the industry was growth of 1.4% in CD revenue to £115.9m - the first increase since 2017. CD still generates slightly more than vinyl for labels and artists, although the change is likely to occur this year as predicted by label execs to Music Week last month.

The CD format benefited from superstar releases by Adele (the year’s biggest album across formats), Ed Sheeran, ABBA and Dave. ABBA’s Voyage was the No.1 seller on vinyl last year.

Geoff Taylor, chief executive BPI, BRIT Awards & Mercury Prize, said: “The UK music market’s return to growth has been driven by streaming – especially streaming subscriptions, which grew by 13% last year and made up 88% of streaming revenues and 58% of total revenues. After a tough few years we are also pleased to see growth across the sector, including in physical formats, sync, performance rights and beyond. This growth yields important benefits for the broader music community, including greater remuneration to a wider base of artists and additional investment by labels in new talent.”

But Taylor added a note of caution at a time when the future model of recorded music is being debated. It echoes the call he made earlier in the year in Music Week for labels to seize export opportunities via streaming.

“It is important to remember that even today we still have yet to fully recover from years of decline and that, in real terms, we remain a much smaller industry than 15 years ago,” he said. “We urge the music community to join together to continue growing the market, for example by helping British music secure the largest possible share of streaming growth abroad. That will be an effective way to maximise the success of British music creators and the ecosystem that supports them.”

The big growth in 2021 was generated by syncs for film, TV, advertising and video games. Although the income for labels of £30.8m is not a large component, it did increase by 47.6% year-on-year.

The BPI figures are based on a survey of its label members, with Official Charts Company market share data used to account for non BPI label members. They are verified against data collected by the IFPI.

Performance rights income from broadcast and public performance was up 10.8% to £117.05m.

Subscribers can read our 2021 analysis here.