The Goldman Sachs Music In The Air report is always a major talking point for the industry.

The 2023 edition has just landed, authored once again by analyst Lisa Yang and colleagues at Goldman Sachs.

With the report suggesting that the industry is entering a period of “major structural change given the persistent under-monetisation of music content, outdated streaming royalty payout structures and the deployment of generative AI ”, this one will undoubtedly be read even more closely by executives.

There is good news for the majors in how the analysts see them navigating the changes.

“Despite fears of market share dilution from the sheer volume of new content created, which will be further exacerbated by AI, we note that UMG and Sony Music broadly maintained their market share of recorded music in 2022, with WMG being the major loser to the independents with market share down 0.48 [percentage points],” stated the report. “We continue to expect modest dilution of market share over time, mostly driven by the revenue mix shift towards [emerging markets], although we believe that the major record labels will continue to expand their presence in EMs through partnerships, investments and bolt-on M&A.”

Here, Music Week looks at some of the key issues for the global industry…

Streaming growth remains strong

Goldman Sachs has revised its growth rates following the latest IFPI figures for 2022, in which streaming revenue performed below its expectations (although overall growth was ahead of the GS forecast).

Those IFPI numbers impact the latest forecasts in Music In The Air 2023. Due to a lower 2022 base, the paid streaming revenue forecast is down 9-10% for 2023 and 2024 compared to last year’s projection. However, while the forecast has been revised down, crucially that forecast is still for strong growth.

According to Music In The Air, the global music market (including live) will be worth $92 billion (gross) in 2023 (last year’s forecast for 2023 was for almost $95bn). By 2024, that figure is projected to be $99.2bn, and by 2030 it is set to pass $150bn ($151.4bn – of which $104.4bn would be the label/publisher revenue or ticket sales/sponsorship for live).

While streaming growth has been slightly downgraded (the lower base for 2022 means that long-term projected growth is down $9bn by 2030 compared to last year’s forecast), music publishing and live pick up the slack. Music publishing is, according to the report, set to be a near $15bn industry by 2030 ($14,7bn), while the live music market will be almost $40bn ($39.5bn).

For recorded music, the net market value is forecast as: 2023 – $28.2bn (up 7.5% year-on-year), 2024 – $30.8bn (up 9.3% year-on-year), 2030 – $50.1bn (8.6% compound annual growth rate).

Streaming’s projected annual compound growth rate of 11% to 2030 has not been revised in the latest report. The overall streaming market is set to be worth $38.4bn gross in 2023 (paid streaming: $26.9bn), $43.7bn in 2024 (paid streaming: $30.2bn) and $80.3bn in 2030 (paid streaming: $51.7bn).

In terms of paying subscribers, the forecast is for 663 million in 2023, 738m in 2024 and 1.2bn by 2030.

When it comes to physical music, the declines of the past decade appear to be tailing off. By 2030, net revenues from physical music will be down to $3.9bn. While that may represent a decline of 15% from 2022, Goldman Sachs actually revised its 2030 forecast up by $1bn compared to last year. Clearly the performance of physical releases by Taylor Swift and King & Prince in Japan points to the enduring appeal of physical.

More price increases coming

Behind those numbers, Goldman Sachs makes certain assumptions based on the trends.

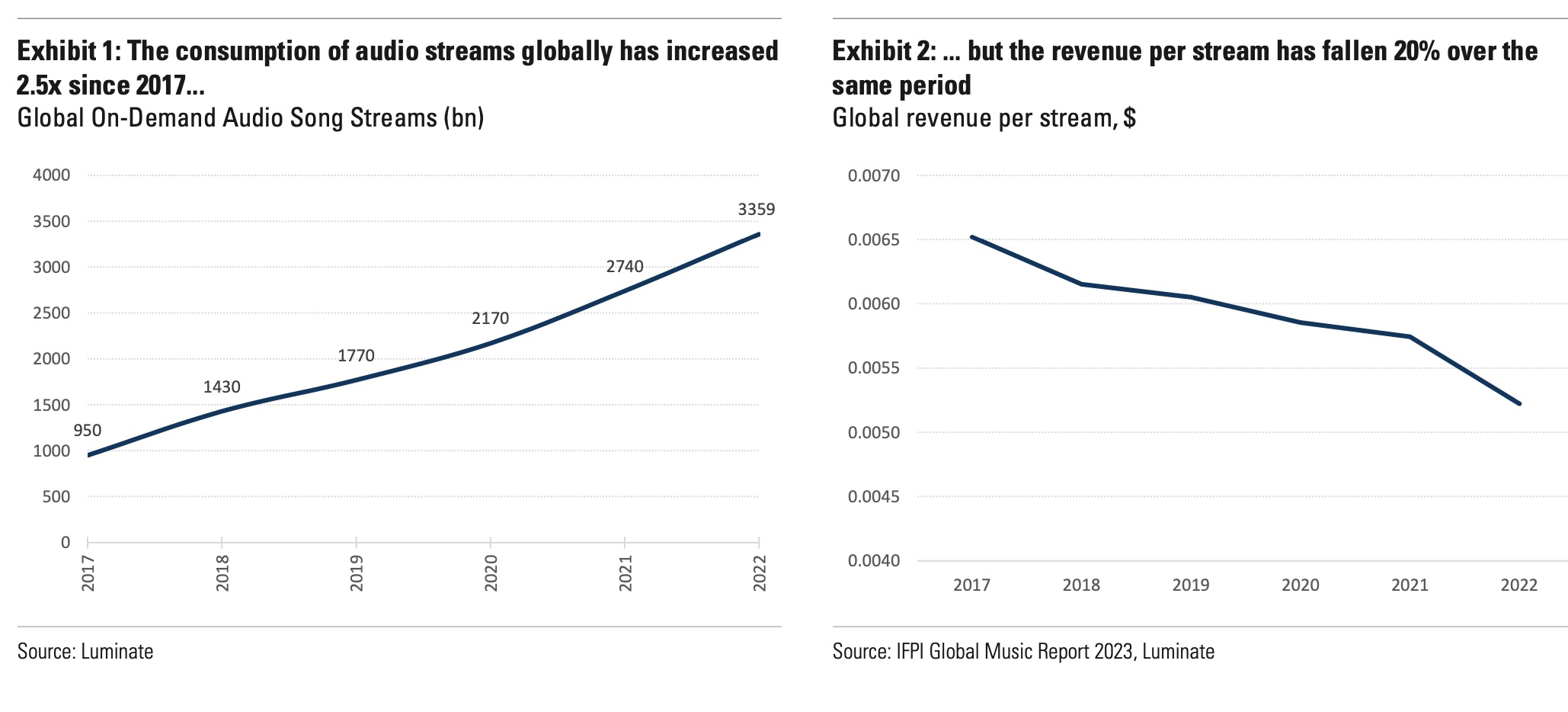

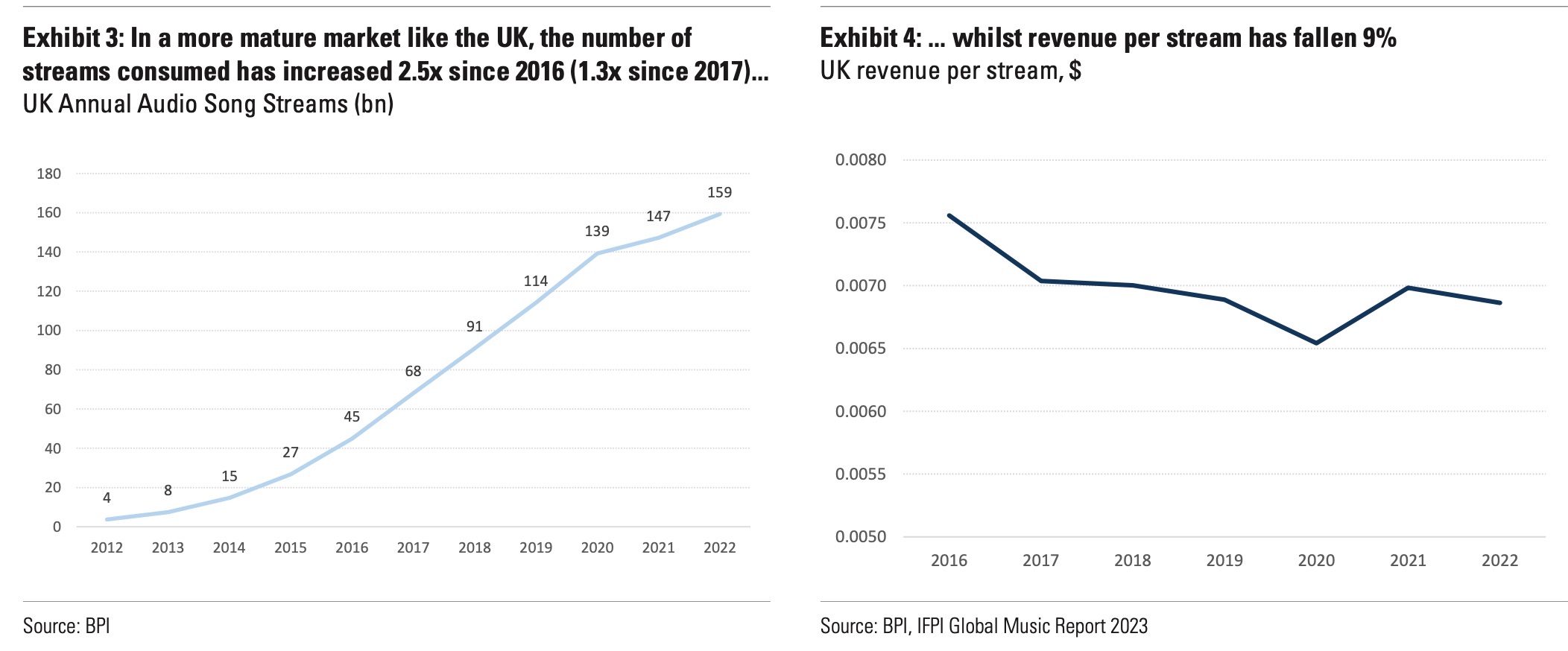

The consumption of audio streams globally has increased by 2.5 times since 2017, but monetisation has lagged behind the growth due to lack of price increases, dilution from bundling of plans and lack of customer segmentation (which we’ll come to later). That effectively means that revenue per stream is falling.

The report noted that paid streaming ARPU (average revenue per user) has fallen 40% since 2016.

Audio streaming has also performed less well than video streaming in terms of revenue growth. The revenue per streaming hour on Spotify is now four times lower than on Netflix (with the caveat that the data is not recent).

Streaming services have started to increase prices, with Deezer, Apple Music and Amazon Music leading the way. Goldman Sachs expects that trend to continue (it factors in annual price increases of 3% into forecasts). There is also no apparent sign of subscriber churn resulting from price increases.

“As such, we expect other major DSPs including Spotify and YouTube Music to raise prices and we note that Spotify is currently in licensing renewal negotiations with the major record labels,” states the report. “We believe that such price increases are not just a one-off and we would expect the industry to work towards implementing price increases on a recurring basis, especially in an environment of higher inflation, and similar to the price increases adopted in other industries such as SVOD.”

Streaming remuneration and superfans

The industry is increasingly focused on bringing in a new model for streaming remuneration, and addressing the impact of fraud by “bad actors” on platforms.

The pro-rata model of streaming remuneration certainly looks ripe for reform. The report digs into the potential changes.

“The model needs to evolve, in our view, to cope with the dilution of market share from (i) the ever-increasing number of songs uploaded onto streaming platforms, with the long tail of music being treated equally to premium music content, (ii) the rise of fraudulent/ artificial streams and (iii) the propensity of algorithms to push lower royalty content,” states the report.

Warner Music CEO Robert Kyncl has noted that for TV subscription, users pay a premium for certain content like sport. At the moment, the pro-rata model does not differentiate between an Ed Sheeran hit or a recording of rainfall. The Goldman Sachs report cites UMG research showing that 80% of customer acquisition and retention on DSPs is based on the availability of superstar artists’ content, classic catalogue and the body of work of career artists, while 44% of superfans subscribe to DSPs for the artists they love.

“As a result, we believe there is a significant opportunity to better monetise artist superfans, which in the download era spent 3x more on music than an average individual, according to UMG consumer research,” states the report.

Goldman Sachs explores the potential of superfans in some detail. While it’s clearly an opportunity, such segmentation within streaming could mean consumers facing much more choice compared to the prevalent standard unlimited model. So far, different plans have largely been limited to high-definition audio and family options.

“Beyond headline price increases, we believe that there is an opportunity for the industry to improve monetisation through a premium segmentation of their user base, which would better align monetisation with the value created by an artist or a song for the platforms,” states the report. “The current streaming model does not distinguish between its users, charging each the same flat monthly fee, independent of the level of engagement with the platform and its artists.”

Monetisation of superfans could represent nearly $2bn of incremental revenue by 2027 and $4bn by 2030. Goldman Sachs estimates that 20% of subscribers are superfans and they would be willing to pay twice as much compared to regular users.

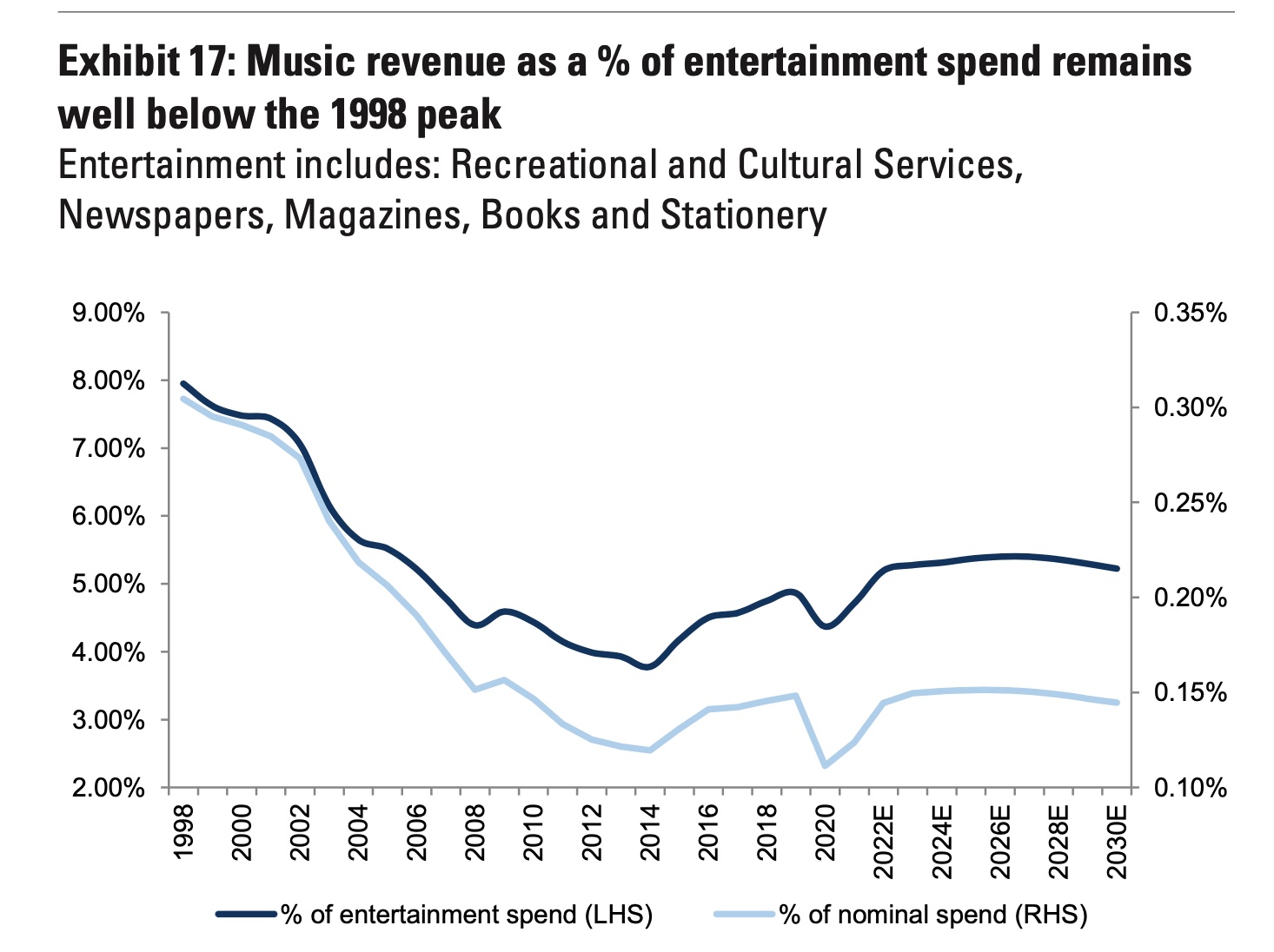

For anyone who considers this a bullish forecast, it’s worth noting that spending on music as a percentage of nominal consumer spending is around 50% lower than in 1998, and it is down from 8% of entertainment spend to around 5%.

While it’s not entirely clear what a superfan option would mean for streaming, Goldman Sachs’ highlighting of this revenue opportunity suggests that it’s an area to watch closely in licensing discussions. Deezer CEO Jeronimo Folgueira recently told Music Week there was a need for new thinking in what fans are offered.

“While we would expect strong appetite from superfans for the opportunity to lean closer in to their favourite artists through their streaming platform, we believe that not all superfans would be monetised immediately given it may take some time/ iterations for the new product and offering to be fully optimised, and such offering may vary depending on the service,” states the report.

AI’s impact on music

As you’d expect, Goldman Sachs takes a close look at generative AI and its contribution to the music industry in the coming decade.

“While it is too early to fully assess the impact of generative AI on the music industry, we see the current technology as further lowering the barriers to entry for content creation, boosting music creation capabilities and improving productivity,” suggests the report. “We believe the quality of the input to large language models is critical and the largest owners of proprietary IP are best positioned to leverage the technology. However, the industry will need to be aligned in controlling its deployment to ensure that the IP remains protected and the user experience is preserved.”

That last sentence is key, although GS believes that investor concern is “overstated”. Any doom mongers predicting that the industry is about to face tech-based disruption on a par with piracy two decades ago should probably read the section on AI.

“Unlike at the end of the 1990s when the music industry faced significant challenges with digital piracy, the industry today is a lot more structured, with a handful of streaming companies controlling most of the music streams and three music companies owning the vast majority of catalogues, making it easier for the industry to remain in control, in our view,” states Goldman Sachs.

“We believe that the large music companies are in a relatively better position to protect their artists and IP given their legal and financial resources and leverage with the DSPs.”

PHOTO: Getty