MIDiA Research has released its annual global recorded music market report for 2020.

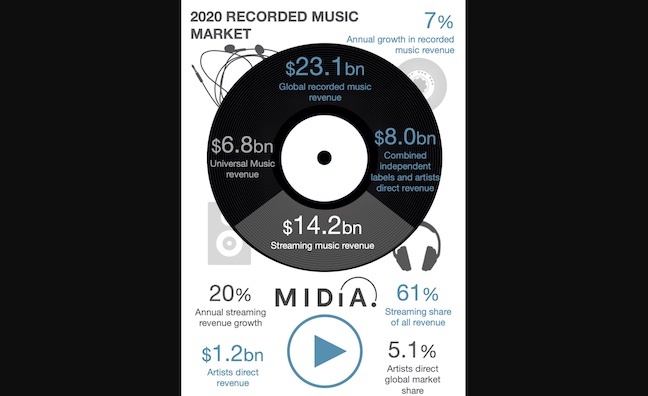

Despite the impact of the pandemic, global recorded music revenues grew by 7% in 2020 to reach $23.1 billion in record label trade revenue terms.

The growth rate was below the 11% increases seen in both 2018 and 2019, reflecting the dampening effect of the pandemic. Despite the increase last year, in cash terms the industry brought in $600m less overall compared to 2019 by failing to hit that same double-digit growth rate this time. The revenue increase was $2.1bn in 2019, while last year it was $1.5bn.

MIDiA’s research comes ahead of the IFPI Global Music Report this month.

Although the recorded music business experienced a dip in the earlier months of the pandemic, the remainder of the year saw industry revenue rebound, making it the sixth successive year of growth. Global revenue was down 3% in Q2 2020 compared to one year earlier, but up to 15% growth in Q4 2020. MIDia said that a strong 2021 may lie ahead if that momentum continues.

Streaming revenues reached $14.2 billion, up 19.6% from 2019. 2020 was another year of accelerating streaming growth, although MIDiA notes that Spotify’s was lower than the market rate.

For the first time, according to the report, the major labels underperformed in the streaming market, but not all majors were affected in the same way. Sony Music Entertainment was entirely in line with streaming market growth, Universal Music Group slightly below and Warner Music Group further down.

The recorded music business is changing, and it is changing fast

Mark Mulligan

Independent labels and artists strongly over-performed the market, collectively growing at 27% and increasing their combined streaming market share to 31.5%.

The major record labels saw collective market share fall from 66.5% in 2019 to 65.5% in 2020. While this shift is part of a long-term market dynamic, most of the dip was down to WMG reporting flat revenues for the year. SME gained share and UMG remained the largest record label with 29.2%. Independent labels also saw a 0.1 point drop in market share, but there was a mixed picture for independents. Independent labels as a whole grew by 6.7% but smaller, newer indies tended to grow faster than the market.

In 2019, direct-releasing artists were the big success story, massively outperforming the market. Last year, the sector grew a further 34.1% to break the billion dollar market for the first time, ending the year on $1.2 billion. It increased market share by more than a percentage point, up to 5.1% in 2020. It reflects a market shift towards a new, emerging generation of DIY artists.

MIDiA’s managing director Mark Mulligan said: "The recordings business managed to deliver a strong performance due solely to the growth of streaming. Streaming has been the engine room since the recorded music business returned to growth, but the fall in performance and sync revenues due to the pandemic highlighted just how overly dependent the global music business has become on streaming.

"With lots of private equity money now pouring into creator tools companies like Native Instruments, expect this space to hot up even further in 2021. The recorded music business is changing, and it is changing fast."