The BPI has issued the 2024 edition of its yearbook covering music industry trends based on data from the Official Charts Company, ERA, and more.

The newly-published volume of market data will be making its way to members of the labels trade body.

A key focus for the yearbook is the independent sector, which has made gains in recent years.

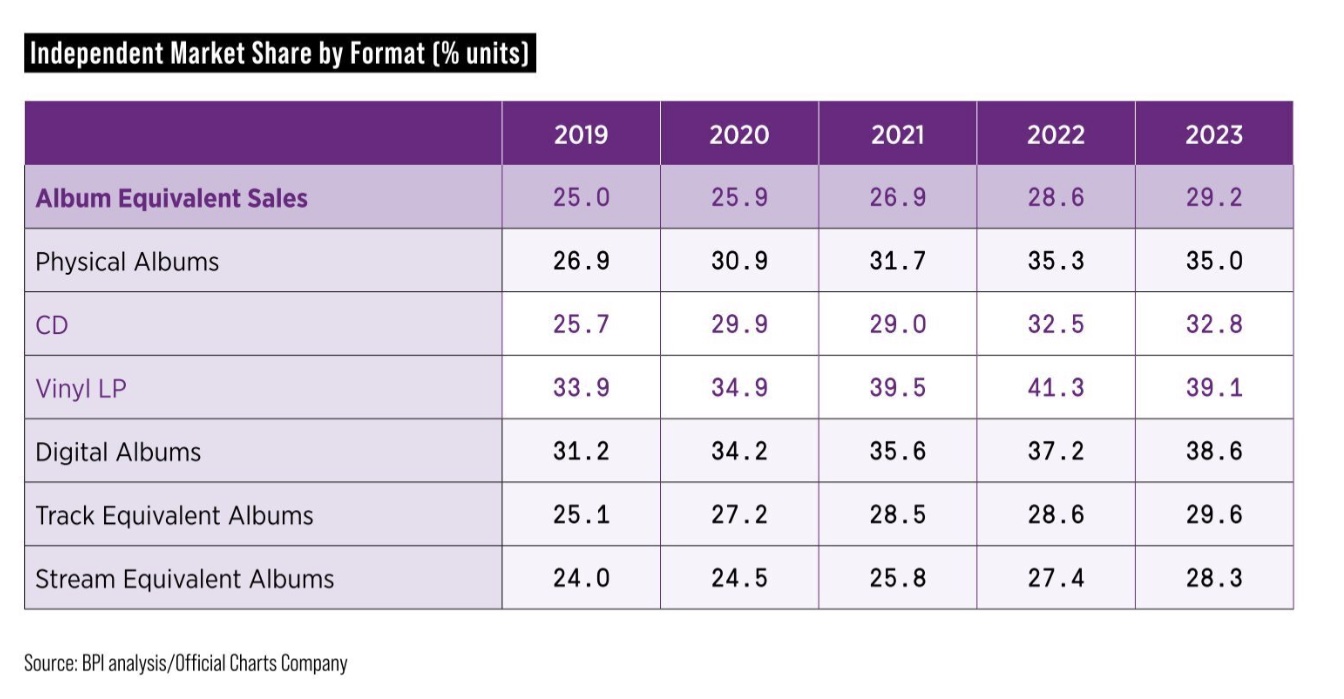

Earlier this year, Music Week revealed that the independent sector accounted for 29.2% of consumption in the UK in 2023, based on Album Equivalent Sales (AES covers combined consumption across all formats). It is the sixth consecutive year of growth for the independent sector.

BMG headed up the indies with a 1.7% share of AES, down slightly from its 1.8% share in 2022, including No.1 albums for Kylie Minogue and Madness. As the company’s recent annual report shows, BMG has been through a period of transition as refocuses on core areas of recorded music and publishing.

XL Beggars was in second place in the independent music AES market share figures (1.3%), followed by AWAL (0.9%), Domino (0.7%) and PIAS (0.4%).

According to BPI analysis based on Official Charts data, more than 60 albums released by independent labels made the weekly Top 10 of the Official Albums Chart in 2023. These included seven chart-topping releases by Ren, Enter Shikari, The Reytons, The Lottery Winners, Kylie Minogue, Madness and Busted, as well as other Top 10 LPs by acts including BRITs winner Casisdead, PJ Harvey, Claire Richards and punk veterans The Damned.

The BPI yearbook also highlights independent successes on the singles chart last year, including a No.1 for record-breaking BRITs winner Raye and Top 10 entries for acts including Central Cee, Bugzy Malone & Teedee, Peggy Gou, Mitski and Lizzy McAlpine.

The independent sector outperformed its overall market share in the physical music market with 35% of all album sales in 2023. Indies also claimed 39.1% of vinyl LPs purchased across the year, with more than 200 indie titles moving at least 1,500 vinyl copies. However, indies’ vinyl share last year was down on the 41.3% in 2022, a year with big vinyl releases from Arctic Monkeys, The 1975 and Wet Leg.

Independent releases made up 32.8% of CDs sold last year (32.5% in 2022) amid signs of a revival for the format. In Q1, CD sales were down slightly year-on-year in contrast to the big drops of previous quarterly figures.

The independent sector also saw a growing share of streaming consumption (SEA – streaming equivalent albums) with a 28.3% share, up from 27.4% in the prior year.

In the singles chart, independent artists making a streaming impact included Raye with the No.1 Escapism (feat 070 Shake). Released via Human Re Sources and distributed by The Orchard under a distribution and services deal for Raye, it was the biggest independent single of last year according to the BPI. (Sony Music is the parent company of the two distributors, who work with indies and self-releasing artists.)

Lizzy McAlpine’s Ceilings (AWAL) was at No.2, followed by It Goes Like (Nanana) by Peggy Gou at No.3 (XL), Let Go by Central Cee (ADA) at No.4 and Golden Hour by Jvke (AWAL) at No.5. Apart from Peggy Gou, the Top 5 is made up of acts using services and distribution partnerships, rather than traditional label deals.

BRITs winners Raye and Jungle (AWAL) both showed that services partnerships can deliver award-winning campaigns at the highest level. Jungle are seeing a BRITs boost for their 2023 track Back On 74, which reached a new peak of No.19 last week.

Catalogue dominated the Top 10 independent albums, wth Arctic Monkeys’ AM (2013) as the year’s most consumed title along with their debut album, Whatever People Say I Am, That’s What I’m Not, at No.2. The Domino-signed band are also at No.5 in the indie rankings with Favourite Worst Nightmare (2007), behind Adele albums 25 (2015) at No.3 and 21 (2011) at No.4 (both via XL).

Arctic Monkeys success was down to strong streaming consumption across their catalogue, particularly for AM, although the titles also sell consistently on vinyl.

More than half of all physical albums purchased in the overall market in 2023 were distributed by Utopia Distribution Services. There were also share increases for Arvato and Proper, whose distributed companies include Cherry Red, Cooking Vinyl, Mascot Label Group, AWAL and Chrysalis.

The UK music industry has always had a healthy and vibrant independent sector

Dr Jo Twist

Almost 400 indie singles and albums reached new BRIT Certified Platinum, Gold or Silver award levels in 2023. These included titles by Freya Ridings, The Prodigy and Dave & AJ Tracey going multi-platinum.

Dr Jo Twist OBE, BPI chief executive officer, said: “The UK music industry has always had a healthy and vibrant independent sector made up of an eclectic mix of many hundreds of labels supporting an extraordinary range of British talent. Their success is underlined by a sixth consecutive year of growth, reflecting both the popularity of their artists on streaming platforms and demand for their releases on vinyl and CD, where they continue to find success with music fans across demographics.

“The growing success of the UK’s independent sector is just one of many stories in the BPI’s essential All About The Music 2024. At a time when the ways we can enjoy music continue to evolve, our yearbook unpicks and analyses this ever-complex ecosystem. It shows an energetic and hugely successful UK recorded music sector, driven by our incredible artists and the record labels that support them.”

Femi Olasehinde, BPI Council independent representative and Just Another Label founder, said: “It’s great to see independents thriving, and not just the more celebrated labels and their artists, but increasingly also a dynamic and entrepreneurial community of much smaller micro-labels and self-releasing artists that are redefining the sector and who, with support, can drive further growth.”

Click here for our analysis of Q1 music consumption with Dr Jo Twist.