During the summer, Hipgnosis CEO and founder Merck Mercuriadis voiced his frustration about the company’s share price not reflecting the “fundamental value of the company”.

Hipgnosis has now unveiled a plan that they believe will help in the re-rating of the share price. It comes at a time of economic challenges including interest rate rises, as well as pressure on the share price of song investors including Hipgnosis.

The big move is a catalogue sale of $465 million – the first time Hipgnosis has divested a significant part of its holding in song copyrights – to fund a share buy back programme of up to $180m and repayment of $250 million drawn under the company’s revolving credit facility.

Hipgnosis has agreed the sale of 29 music catalogues for $440 million (reflecting a multiple of 18.3x historical Net Publisher Share) to Hipgnosis Songs Capital, the partnership between Hipgnosis Song Management and investment manager Blackstone. It is expected to realise a total net return of 44% over a three-year weighted average life of ownership.

There is also a ‘go shop’ provision for the board to solicit alternative offers for 40 days from this announcement.

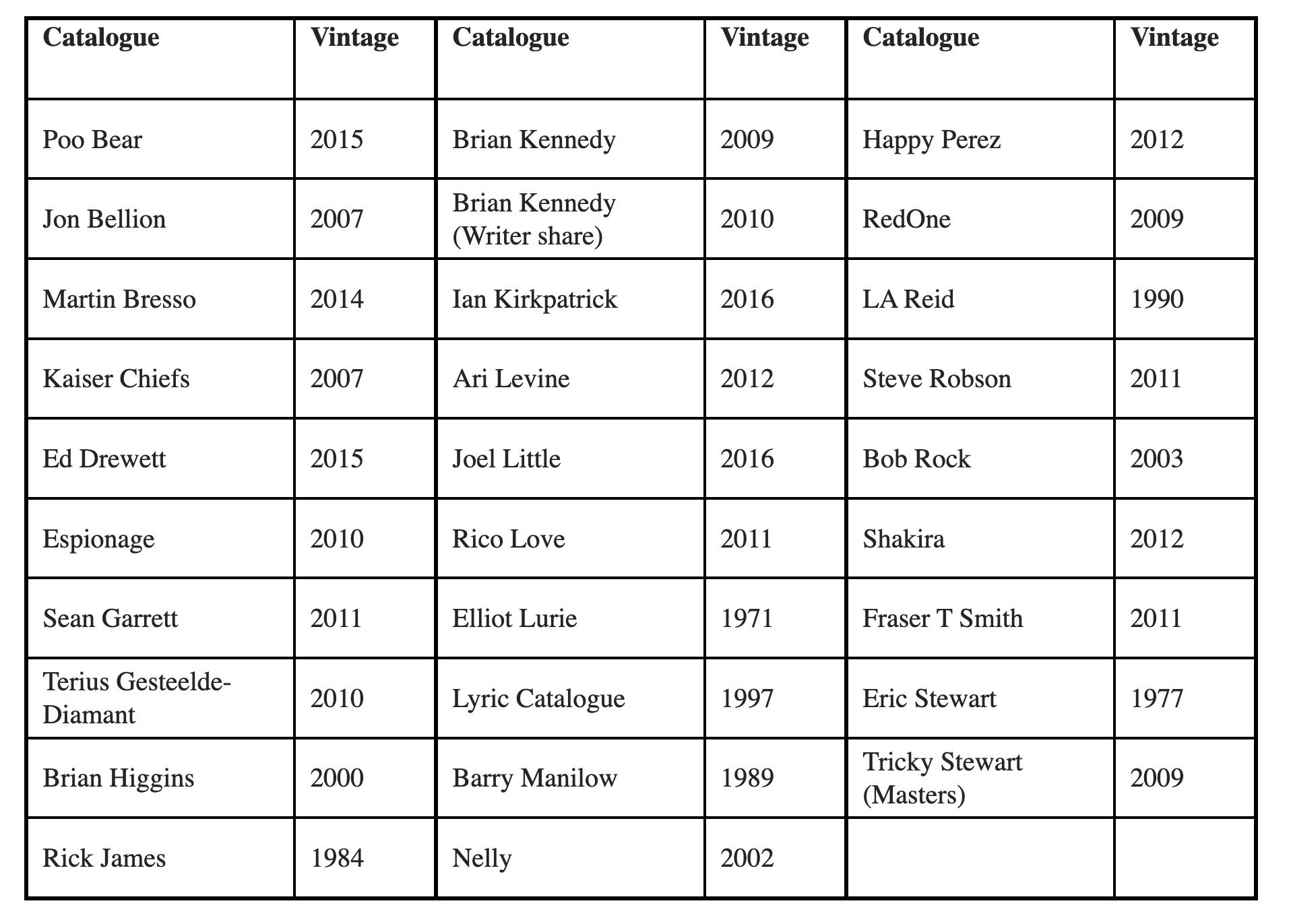

The sale includes catalogues by Kaiser Chiefs, Nelly, Shakira and Fraser T Smith, see below for all 29:

While this plan has been drawn up, the share price has actually had a boost in recent days as a result of the Round Hill Royalty Fund acquisition by Concord. Although Hipgnosis could yet be subject to an acquisition by an institutional investor, at a valuation of $2.7 billion that would be a huge undertaking – more than five times the size of the Round Hill deal.

Hipgnosis said that the remaining portfolio will have an “increased concentration of culturally important and successful songs”. Hipgnosis Songs Fund will retain its ownership in seven of its ten largest catalogues.

Music Week understands that Hipgnosis continues to buy catalogues.

All catalogues would continue to be managed by Hipgnosis Song Management, following the sale. The company has also agreed additional, lower investment advisory fee tiers with Blackstone.

In addition, the company has agreed to sell a portfolio of non-core songs for $25m. These songs were acquired as part of Kobalt Fund One and their eventual sale was part of the acquisition strategy, as Hipgnosis does not have perpetual ownership rights.

“Given the substantial share price discount to fundamental value in recent months, share buy backs enable the company to invest further into the remaining portfolio at a material discount to its fundamental asset value,” noted the company in its announcement.

The board intends to unanimously recommend that shareholders vote in favour of these resolutions at the EGM and the 2023 AGM next month.

Merck Mercuriadis, CEO and Founder of Hipgnosis Song Management and Founder of Hipgnosis Songs Fund, said: “Earlier this year we initiated consultations with shareholders, in contemplation of the continuation vote and our concerns that the true value of our iconic songs was not being reflected in our share price. It was clear that shareholders shared our belief in the continuing long-term opportunity of Hipgnosis Songs Fund and wished to see a significant share buy back programme and reduction of our leverage in order to deliver a re-rating in the share price.

“The transactions announced today allow us to execute on that strategy and reflect our determination to deliver immediate shareholder value and enhance the company’s position to deliver long-term exceptional returns and capital growth through our investment strategy of ‘buying, holding and actively managing’ a major portfolio of iconic songs as they benefit from the continued growth of streaming.

“I’m delighted that through this transaction with Hipgnosis Songs Capital, not only are we able to execute the strategy of share buy backs and reducing leverage but also give clear transactional evidence, alongside other recent transactions in the market, of the current realisable value of the company’s catalogues to help investors understand and have confidence in the company’s asset value. The purchase price of the sale of catalogues to Hipgnosis Songs Capital realises a total return of 44%, which validates our investment strategy despite the current economic challenges.”

Mercuriadis stressed that the company has been “built upon our ethos and commitment to songwriters to be conscientious custodians of their songs.”

The purchase price of the sale of catalogues to Hipgnosis Songs Capital validates our investment strategy despite the current economic challenges

Merck Mercuriadis

“I believe these deals will deliver immediate value for shareholders through a re-rating of the shares and position Hipgnosis Songs Fund to deliver superior returns to shareholders over the medium and long-term,” added Mercuriadis.

“The company recently delivered the best like-for-like results in its history and is in a perfect position to capitalise on the demonstrated pricing power of the DSPs, successful passing of CRB III and CRB IV and songwriters being paid at the highest rates ever in the streaming era as we see more than a billion paid subscribers to music streaming services in sight. All this gives us great confidence for the future.

“With the support of our shareholders in the continuation vote, Hipgnosis Songs Fund will move forward stronger than before with a portfolio of culturally significant, iconic songs that will be listened to for decades to come, providing long-term resilient income streams and the potential for significant capital growth.”

Andrew Sutch, chairman of Hipgnosis Songs Fund, said: “As a board, we have been clear for some time that the company’s share price does not fully reflect the value of Hipgnosis Songs Fund’s portfolio. Having consulted with many of our largest shareholders, considered a wide range of options and taken independent advice we are confident the proposals set out today provide a compelling opportunity to deliver immediate shareholder value whilst protecting our ability to deliver superior returns over the medium term.”

He added: “We believe the proposals set out today provide the best way to balance immediate shareholder value with the exciting longer-term prospects for the company. Therefore, the board intends to unanimously recommend shareholders support these proposals and vote in favour of the resolutions at the Extraordinary General Meeting and the 2023 AGM.”

Pryor Cashman is acting as US and special music counsel to Hipgnosis in this significant transaction. The team is led by James Janowitz, Michael Weinsier, Frank Scibilia, John Crowe, and Eric Wisostsky, with assistance from Sophia Sofferman, Joshua Weigensberg, RJ McLaughlin, Bianka Valbrun, Shrivats Sanganeria and Taylor Weinstein. Hipgnosis is also represented in the transaction by its regular UK corporate counsel, Herbert Smith Freehills.